Every spring comes, Tet bonuses are always something that every worker looks forward to. Because this is the result after a year of working and dedicating yourself to the company. So what is Tet bonus? What are the regulations and calculation of Tet bonuses? Join us to find out in the article below.

What is Tet Bonus?

Tet bonus is the amount of money (can be assets or other forms) that businesses and companies pay to employees at the end of the year (usually at the end of December of the solar calendar or before the Lunar New Year) and has the agreement between businesses and employees.

Pursuant to Article 104 of the 2019 Labor Code, regulations on bonuses are as follows:

“Bonus is the amount of money or property or in other forms that the employer rewards the employee based on the employee's production and business results and the level of job completion.

Bonus regulations are decided by the employer and publicly announced at the workplace after consulting with the grassroots employee representative organization for places where there is an employee representative organization at the workplace. department.”

It can be simply understood that the Tet bonus is a bonus based on the bonus regulations of companies and businesses. The bonus depends more or less on the production and business status of that enterprise and the level of work completion of the employees during the year.

Nowadays, many businesses base on employee seniority to calculate employee bonuses. In many units, Tet bonuses and 13th month salaries are combined to pay employees before the Lunar New Year.

Regulations on holiday bonuses and Tet 2024

Currently, there are no regulations or regulations requiring businesses to give Tet bonuses to employees. Whether or not to reward will depend on the business's decision.

The law allows businesses to give Tet bonuses in money or in materials or in kind, but publicize the reward regulations for the collective to know. Therefore, there is no minimum or maximum limit for Tet bonuses.

In short, specific issues about standards, time, bonus levels, methods, funding sources, etc. will be clearly shown in the enterprise's regulations. In addition, employees' Tet bonuses are clearly agreed in the labor contract or collective labor agreement.

Tet bonuses also depend on the economic situation and revenue of each company. If the organization's business operations are stable and good, Tet bonuses for employees will be high. On the contrary, if the business situation of the enterprise is not good or not positive, there will be little or even no Tet bonus for employees.

Tet bonuses have great significance in promoting the working spirit and contributions of employees, ensuring fairness in salary and bonus issues. In the job recruitment market, many businesses use bonuses as a strategy to attract talent, stabilize local human resources and develop the organization, and build competitive advantage in the market.

SEE MORE: What is 13th month salary? Things to know about 13th month salary

How to calculate Tet bonus 2024

As mentioned above, Tet bonus is not a mandatory amount of money paid by businesses to employees. Therefore, depending on the conditions, actual capabilities, and business situation of each business, there will be different ways to calculate Tet bonuses. And to avoid being disadvantaged, workers need to clearly understand the following issues:

Popular Tet bonus regulations

- Based on the business situation of the enterprise to know whether the company's employees will receive Tet bonuses that year or not. If the business is profitable, the company will deduct a portion of the profits to reward employees. The amount of the bonus will depend on the profits earned each year.

- Depending on the labor productivity and seniority of each employee, calculate the Tet bonus accordingly.

Tet bonus calculation formula

| Bonus level = Bonus rate (% labor productivity + % seniority) x Average monthly salary |

In there:

% labor productivity: Based on employee evaluation results of department heads and direct managers (For example: Excellent = 100%; Good = 80%; Good = 50%; Average = 30%; Weak = 10%)

% working seniority: Calculated from the date of signing the official contract to December 31 of that year (For example: Under 1 year = 10%; From 1 - 2 years = 30%; From 2 - 3 years = 50%; From 3 - 4 years = 70%; From 5 - 7 years = 90%; From 7 years or more = 100%)

Eg:

A business has decided to give a 2024 Lunar New Year bonus according to the contract. This amount will be based on the employee's performance and seniority. When the employee has worked for 3 years, with a fixed salary of 15 million VND and is evaluated by management as 80%.

From there, the bonus is calculated as follows: 15 million VND x (80% + 50%) = 18 million VND.

Related questions about Tet Bonus

Around the issue of year-end bonuses, there are many related questions and concerns. Below are questions related to the regulations on Tet Bonus 2024 that employees definitely need to know:

Is Tet bonus the 13th month salary?

In fact, Tet bonus and 13th month salary are two different issues. Some businesses today have a clear distinction between these two concepts, specifically as follows:

- Tet bonus is a bonus proportional to the company's profits and business situation, depending on the Director, without prior agreement with employees.

- The 13th month salary is the amount of money the business rewards employees based on previous agreements with the business.

Don't miss: What is a contract salary? Things you don't know about salary

Does Tet bonus include social insurance?

According to regulations, social insurance contributions are salary, salary allowances and other additional payments. Compulsory social insurance salaries do not include other benefits and benefits, such as bonuses as prescribed in Article 103 of the Labor Code.

Hence the Tet bonus No need to pay social insurance. But, if according to the labor contract, this amount is recorded in the salary section, the employee still has to pay social insurance.

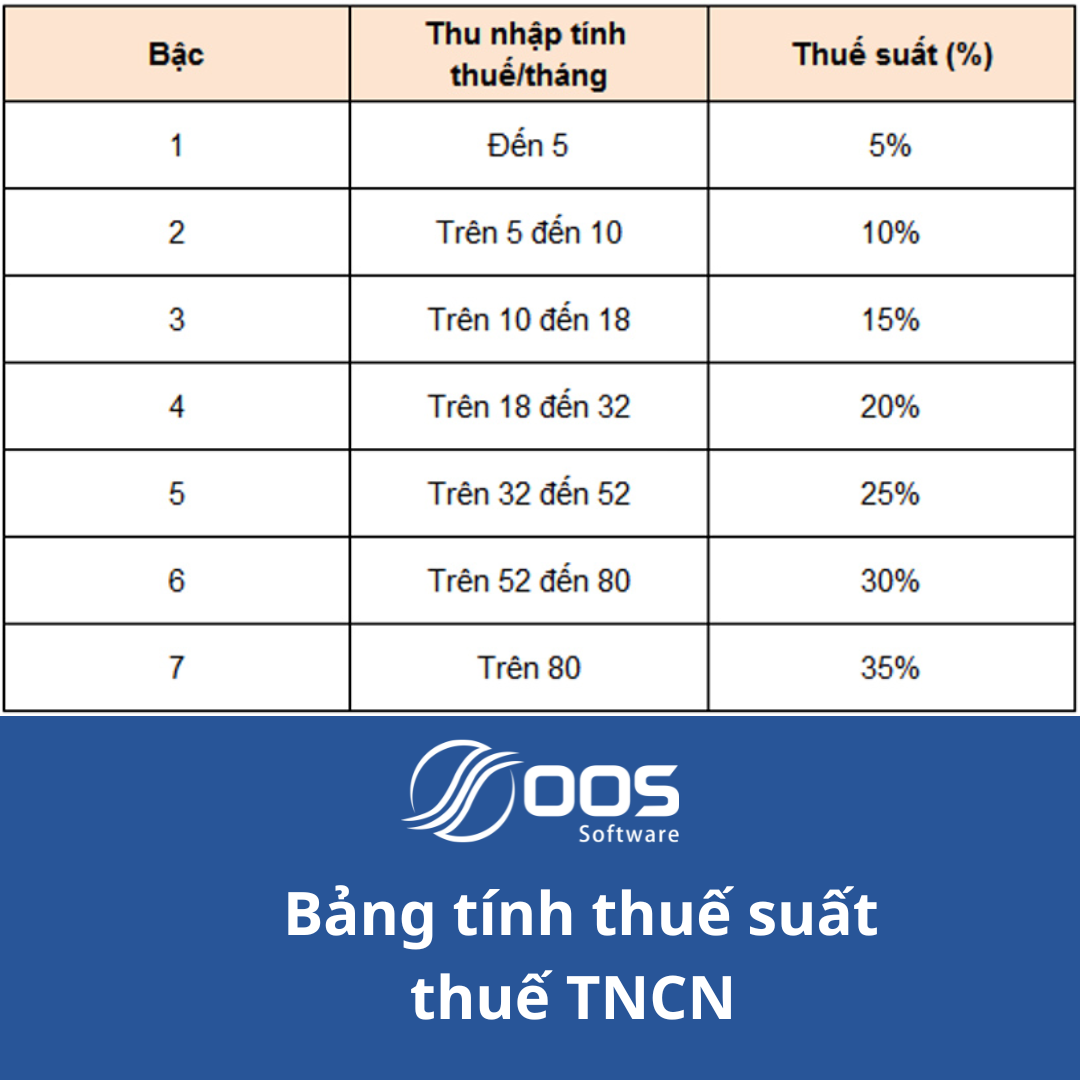

Are Tet bonuses subject to personal income tax?

The Labor Code stipulates that Tet bonuses are remunerations in the nature of wages and salaries. Therefore, according to the provisions of the Personal Income Tax Law, this bonus is subject to personal income tax according to the provisions of law if it reaches the annual taxable level.

Can I get a Tet bonus on probation?

There are no regulations requiring businesses to reward employees; whether or not to reward and what level of bonus will be decided by the business. Therefore, employees who are in the probationary period may not be rewarded because they have not worked for a long time and have not had many achievements or contributions to the development of the business.

Besides Tet bonuses, what amounts of money must businesses pay on this occasion?

In addition to Tet bonuses, employees can receive overtime bonuses or overtime pay if they still have to work during Tet. Specifically, on Tet holidays, workers are entitled to a salary of at least 300%. If you work at night, you will be paid at least 30% of the actual salary of a normal working day.

Can businesses that do not give Tet bonuses be punished?

Base According to Clause 2, Article 17 of Decree 12/2022/ND-CP, Fines will be imposed on businesses if they violate one of the following acts such as not paying or not paying enough wages to employees as agreed upon.

Therefore, in case the labor contract stipulates a Tet bonus, the enterprise does not comply with the agreement and may be sanctioned.

Can I get a Tet bonus if I quit my job before Tet?

According to the law, there are no regulations requiring businesses to give Tet bonuses to employees. However, according to Clause 1, Article 13 of the 2019 Labor Code, it is stipulated: "A labor contract is an agreement between an employee and an employer regarding paid employment, wages, working conditions, rights and obligations of each party in the labor relationship."

Therefore, if in the labor contract between the business owner and the employee there is an agreement on bonus payment after the end of the year and paid before the Lunar New Year, the business needs to pay the bonus. for employees according to previous agreements.

Although not a mandatory regulation, Tet bonuses are always a strategy to help businesses build competitive advantages in attracting talent and retaining good employees. Hopefully through this article, both employees and business owners understand and understand their rights regarding Tet bonuses.